Europe's online source of news, data & analysis for professionals involved in packaged media and new delivery technologies

The changing role of TV displays

It is not so long ago that the main TV set in a European household sat in the corner of the living room with the sole purpose of receiving programmes from a relatively limited number of channels, delivered over the air or from a local cable operator. How things have changed, ponders JIM BOTTOMS, Corporate Development Managing Director at Futuresource Consulting.

A ‘TV’ today is a multi-media device capable of accessing and displaying a wide range of content from a multitude of sources, and in numerous different formats. Multiple inputs in a variety of configurations enable a growing number of external devices to be connected: the video player has been joined by set top boxes, games consoles and computers – connected directly to the set or via a home network.

The advent of digital satellite and cable services during the past decade has resulted in a phenomenal increase in the number of TV channels on offer, reaching several hundred in many countries.

Methods of delivery have also changed. Many European countries now have digital over-the-air services, with analogue broadcasts already switched off or due to be very soon. HD services are appearing alongside their SD counterparts and it won’t be too long before they begin to replace them. Internet connectivity is becoming increasingly commonplace, providing direct access to websites like YouTube as well as the catch-up services now offered as standard by the major broadcasters, led by the BBC’s iPlayer.

An area where Europe lagged behind the US for many years was screen size. A drawback of cathode ray tube TVs was that the larger the screen size, the deeper the set had to be. This was less of a problem in the typically much larger American homes, but in Europe it was a major issue. The result was that average screen sizes ‘stalled’ at 28-32”.

Flat panels have been around now for the best part of a decade, but it is only in the past two or three years that screens measuring 42” and above have become affordable for the average household. The arrival of more attractive price-points in this segment has encouraged a huge consumer demand for larger sized panels.

The UK continues to lead the market in Europe, with TV shipments growing 7% in 2009 to reach over 10m units. However, the rapidly falling prices experienced during the latter half of 2008 and into 2009 have had a negative impact on TV manufacturers, with overall revenues falling 10% despite a growth in shipments.

Futuresource expects the market to grow a further 3% in 2010, driven by value-added features such as LED back lighting, high screen refresh rates, ultra-thin screen technologies and, of course, the development and availability of 3D TVs.

The leading hardware brands are already vying to carve out an early position in 3D and set purchases ahead of any readily available content will seed the 3D market in much the same way as the HD market was primed five years ago.

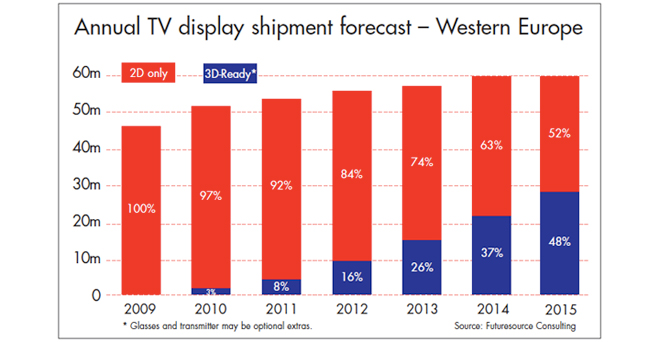

By 2015 we expect the majority of TVs on the market will be ‘3D-Ready’ and the normal replacement cycle will result in a good proportion of households in Europe, the USA and Japan having a 3D-capable display.

LCD continues to account for more than 90% of TV sales, compared with just 8% for plasma. We expect LED backlighting to account for nearly 20% of LCD TV demand this year, providing the benefit of a slimmer form factor, improved picture quality and greatly reduced power consumption. Plasma will continue to lose share to LCD, but it will remain significant in the larger (+50”) screen sizes where it currently accounts for around 70% of the segment.

Continued migration to larger screen sizes will also be a key driver for growth. 40” and above accounted for 24% of flat panel volumes in 2009, and this will rise to more than 40% by 2014 as early purchasers of flat panel TVs upgrade to larger sets.

As the screen size approaches 50” the shortcomings of SD become increasingly apparent and even untrained eyes begin to appreciate the benefits of HD’s four-fold increase in resolution . Even the sophisticated picture processing in the latest generation of displays struggles to improve Internet-delivered images from user generated content sites such as YouTube, although amazingly many consumers still appear happy to watch them. An endorsement, perhaps, of the theory that ultimately it’s content, not technology, which drives the market.

Connected TV s are expected to represent around 20% of flat panel demand this year. Most major manufacturers have already launched products that allow the delivery of over-the-top (OTT) services via the Web; everything from basic news and weather feeds to social networking, catch-up TV and paid-for movie streaming services. One example of the latter is the Lovefilm movie rental service which is being offered on Samsung and Sony connected TV products in the UK.

This broadening in the range of content brought about by a TV’s access to multiple programme sources presents a new challenge for TV manufacturers: supporting all the different formats by which it is delivered whilst maintaining realistic retail price points.

Digital TV has traditionally been encoded using MPEG-2, recently joined by MPEG-4 AVC as broadcasters migrate from SD to HD but strive to minimise the additional data overhead. There are also a couple of different audio formats and transmission standards, but overall it’s a fairly manageable situation.

However, whilst the network connection on the back of the TV may be a standard RJ45 socket, on the Internet it is anarchy. Numerous video and audio coding systems exist, most of which have nothing in common with the long-established broadcasting standards, and the different software configurations – the majority designed for easily reprogrammable computer platforms – present a huge challenge for an industry that has been used to shipping a piece of hardware which is intended to last seven or more years without further intervention.

TV manufacturers must now make a commercial decision whether to support all these various options – as well as new display features such as 200Hz and 3D – in order to attract the widest market, or take a gamble on which one(s) might succeed in the longer term. Several have opted for the ‘walled garden’ approach, offering a limited range of services running on dedicated platforms like Yahoo! Widgets.

Assuming for a moment that consumers are motivated to connect their TVs to the Internet (not a straightforward procedure for the non-tech savvy), many are likely to be unhappy with the restricted number of services on offer and will demand access to a wider range of content. However, delivering multiple services to connected TVs is also technically complex and frequently requires users to get to grips with ‘firmware upgrades’ in order to receive some of the programming on offer.

Efforts are being made to bring some standardisation to the delivery of OTT services – the UK’s Project Canvas and HbbTV, a proposal favoured in France and Germany, being two such initiatives – but they are not universally supported and their success is therefore by no means assured. In fact, it may be that the driver for connected TVs turns out to be something less obvious…

Panasonic and LG, for example, have recently teamed up with Skype to offer a ‘family friendly’ version of the service. Instead of a PC-mounted webcam, a specially designed high resolution , wide angle camera and multi-microphone unit can pick up several family members sitting on a sofa in front of the living room TV and enable them to have a virtual get-together with relatives or friends in another location.

Could this turn out to be the ‘killer app’ that encourages consumers to connect their TVs?

Contact: www.futuresource-consulting.com

This editorial feature is one of many quality analyses published in DVD and Beyond 2010. Click here to reserve your free copy....

On predicting the future

Predicting the future, let alone the future of packaged media, is a perilous exercise, and possibly counter-productive, as the exercise closes doors rather than keep them open, argues JEAN-LUC RENAUD, DVD Intelligence publisher. Consider that: Apple was left nearly for dead 15 years ago. Today, it became the world's most valuable technology company, topping Microsoft.

Le cinéma est une invention sans avenir (the cinema is an invention without any future) famously claimed the Lumière Brothers some 120 years ago. Well. The cinématographe grew into a big business, even bigger in times of economic crisis when people have little money to spend on any other business.

The advent of radio, then television, was to kill the cinema. With a plethora of digital TV channels, a huge DVD market, a wealth of online delivery options, a massive counterfeit underworld and illegal downloading on a large scale, cinema box office last year broke records!

The telephone was said to have no future when it came about. Today, 5 billion handsets are in use worldwide. People prioritize mobile phones over drinking water in many Third World countries.

No-one predicted the arrival of the iPod only one year before it broke loose in an unsuspecting market. Even fewer predicted it was going to revolutionise the economics of music distribution. Likewise, no-one saw the iPhone coming and even fewer forecast the birth of the developers' industry it ignited. And it changed the concept of mobile phone.

Make no mistake, the iPad will have a profound impact on the publishing world. It will bring new players, and smaller, perhaps more creative content creators.

And who predicted the revival of vinyl?

(click to continue)... Read More...